Integrating Artificial Intelligence in Banking Fraud Prevention: A Focus on Deep Learning and Data Analytics

Keywords:

Artificial Intelligence (AI), Biometric verifications, Credit scoring, Deep learning, Fraud detection, Graph analyticsAbstract

Khurshed Iqbal

University College of Zhob(UCoZ), Campus, BUITEMS, Department of Management Sciences

ABSTRACT

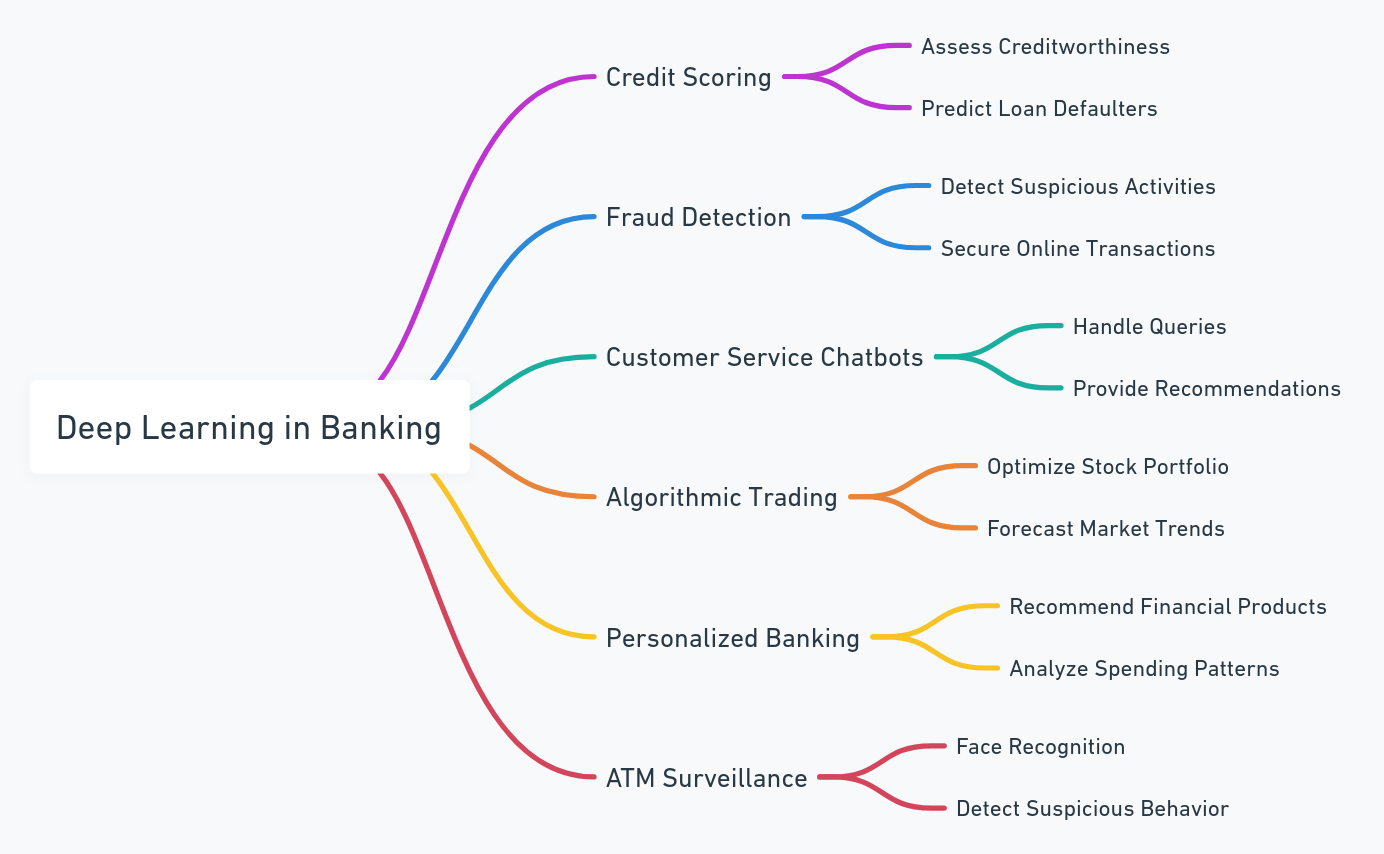

The prevention of banking fraud and the management of risks are critical in today's financial world, and the application of Artificial Intelligence (AI) shows great promise in enhancing these areas. This research explores the diverse roles of AI in identifying, preventing, and handling fraud within banks. Traditional systems for detecting fraud, which are mainly based on set rules, often struggle with immediate detection. However, AI has the capacity to rapidly process large amounts of transaction data, identifying irregularities and potential fraud as they occur. A key technique is the use of deep learning, especially neural networks, which can identify complex patterns and forecast fraudulent transactions with high accuracy when trained on past fraud data. Additionally, Natural Language Processing (NLP) can improve Know Your Customer (KYC) processes by analyzing text from various sources to confirm customer identity. Graph analytics provides a novel way to view transactional connections, which can reveal suspect activities like quick money transfers that may suggest money laundering. Predictive analytics goes beyond conventional credit scoring by using varied data sets for a fuller understanding of a customer's credit status. The study also highlights the value of user-friendly tools like AI-driven chatbots for quick reporting of suspicious activities and the use of advanced biometric checks, such as face and voice recognition. The security is further enhanced by geospatial analysis and behavioral biometrics that study transaction locations and user behavior patterns. A key benefit of AI is its ability to adapt. Self-learning systems keep up with evolving fraudulent methods, maintaining their effectiveness. This adaptability also applies to detecting phishing, integrating with the Internet of Things (IoT), and analyzing across different channels, offering a robust defense against complex fraud attempts. Furthermore, AI's ability to model economic scenarios helps in proactive risk management, and its role in ensuring regulatory compliance makes a typically arduous process more efficient.